When you deposit money in a bank or credit union, you may need to fill out a deposit slip to direct the funds to the right place. Deposit slips identify you and provide instructions to your how to write a deposit slip financial institution. Submit the deposit slip, along with the cash and checks to be deposited, to the bank teller. The teller may also give you a copy of your submitted deposit slip.

Free Lifting Equipment Audit Checklist Templates (PDF, DOC)

- If you’d like to learn more about checks, check out our in-depth interview with Gina D’Amore.

- Banks play an essential role in the business sector for money transactions.

- Keep in mind that most banks have a limit to the amount of mobile deposits you can make each day.

- Your bank sets rules, known as the funds availability policy, which explain how long you need to wait before spending money from a deposit.

- For example, if you have a $50 check to deposit but want half in your pocket, you can write $25 in the designated space to subtract from your deposit.

- They can be used to make deposits both in the lobby and in the bank’s drive-through lane.

Just be sure to add up your subtotal and net deposit correctly, and you’ll likely need your ID to finish the process. Double-check all your information before handing it over to the teller as well. If you’re keeping some or all of the cash from a check and cash deposit, you usually must sign the deposit slip. Sign the deposit slip in blue or black ink and include any other required information. If you’re making a remote deposit with your mobile device, you typically don’t need to use a deposit slip. At most banks, you’re already logged into your account when you snap a photo of the check, so you don’t need to provide those details.

Pros and Cons of Direct Deposit

Include the check number and the amount of each check separately. If you don’t have any checks to deposit, move on to the subtotal. Specify whether you wish your deposit to go to a checking, savings, or business account. In this article, we’ll include detailed instructions on how to fill out a deposit slip, as well as the benefits of using these forms. We’ll also include an example of a deposit slip for easy reference. ✝ To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score.

Online Investments

- Also, businesses may be able to deposit checks using a check scanner, depending on the bank.

- Electronic direct deposits will be available on the day we receive the deposit.

- In addition, mobile deposits — which are typically made through your bank’s smartphone app — typically don’t require you to fill out a deposit slip.

- If you don’t have any checks to deposit, move on to the subtotal.

- If you’re depositing money into someone else’s account, know that not all banks allow this.

- Then, when you bring your deposit to the bank teller, they’ll hand you $25 and deposit $25 into your account.

If you received your deposit slip as part of your check order, your bank account number may already be printed on the slip. The deposit slip might also require you to supply your bank’s routing number. PNC’s deposit slips include a space for a three-digit Regional ID code; however, it’s not required to supply this code when making a deposit. Mobile deposits are a convenient way to transfer money into the bank.

Then, you must write the amount that you are going to deposit either in cash or in check. In this digital age, it is expected that almost everything can be transacted electronically. You may also opt an electronic deposit or you can transfer money from one bank to another. This will save you from the additional work of withdrawal from one account and depositing it to another account. Additionally, you need to endorse any checks by signing the back and adding any additional information required by the bank. For deposit-enabled ATMs, there is no need for deposit slips or envelopes when the ATM is equipped with scanning technology that can capture the image of your check.

Are You Required to Sign a Deposit Slip?

If submitting your deposit to an ATM, be sure to include the deposit slip, along with all of the cash and checks listed on it, in a sealed envelope. A deposit slip template is a piece of paper that you have to fill out when you deposit into any bank account. The deposit slip is given by the bank to the customer that contains information about the way of deposit such as cheque or cash, account number, and date. Here is a list of deposit slip templates you can download here. Upon receiving the deposit slip along with the cash or check, the teller provides the depositor with a receipt of the transaction.

Popular Templates

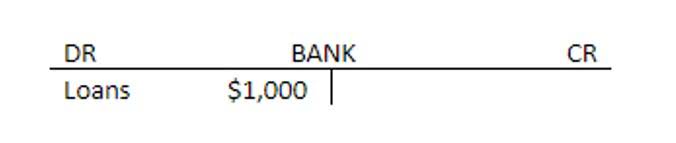

The bank issues a document that contains the necessary information about the service that banks provide, which serves as proof of their service. The banking system encourages https://www.bookstime.com/ people to save and secures their money in banks. The banking system makes comfort for people to deposit and make loan transactions of money through banks.

- Next, fill in additional details such as the date of deposit and, sometimes, the branch information if required.

- If you have online banking, then you can submit this request online to get a copy of the deposit slip.

- They provide essential information to the bank and need to be completed correctly.

- In everything we do, we always make sure that we keep track all of our transactions especially when it comes to dealing with money.

- In our collection, you can find printable cash deposit slips in a variety of designs to make an appropriate deposit slip for the bank and post office.